Accepting Card Payments

In 2018, card payments were the most used payment method. 15.1 billion payments were made by card. By 2028, this amount is projected to reach 22.3 billion with contactless payments accounting for nearly two-thirds of that total.

Here are the 3 main things I think you need to look at when deciding on which company to use.

Costs

Hardware & Software

How long it takes to get paid.

Costs

Every card payment you make, you will lose a percentage of that sale in processing fees. The rate is usually around 1.75%. To give you an example, if you make a sale of £60, £1.05 of that sale will go to the company who manages your payment system. Different companies charge different rates depending on the package you sign up for. Some companies may charge a flat-rate monthly fee, but most seem to take a percentage of each sale.

Some companies also offer the ability to accept payments over the phone. The risk of fraud on this can be very high, so it is important to make sure you are speaking with the cardholder. The other thing to note that payments over the phone have a higher processing fee, from doing my research this is 2.5%. It is nice to have the option of being able to do this, but I wouldn’t recommend doing this all the time.

Always read the small print when deciding on which provider to go with and make sure there are no hidden costs. Some companies may want you to sign a contract for a minimum term and may change the rate to make it more attractive to sign up with them. A lot of them have 30-day rolling contracts, which is probably the better idea because business can change at a quick and rapid rate so having flexibility is great, even if you are paying a little more a month for this.

Hardware & Software

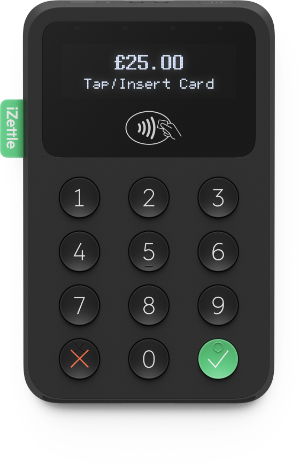

The next thing you will want to consider is the hardware which you will be using to take payments. The great thing about most of the newer card readers is that they are easier to move around and not stuck to one place, making them accessible for everyone. The downside is that you have to make sure to keep it charged and remember to plug it in if it’s not being used. A lot of them now accept contactless payments and also Apple Pay or Google Pay so people can use their mobile phones to pay too.

A lot of card terminals require an internet connection when using, so it is vital to make sure it is available. You could also tether it to your smartphones internet if wifi is not available. As technology is always advancing, companies are now releasing card readers that have 3G/4G built into the system itself, which could be helpful if you have no wifi or your smartphones internet isn’t available.

Some card terminals can print receipts, but a lot of the newer ones are pushing for digital receipts via email or text message which makes them more eco-friendly and convenient for customers who may have a habit of losing receipts.

The new card terminals can connect to a lot of modern smartphones and tablets. These will then used as your POS (Point of Sale) to input prices for the card reader to process. The apps can also be used for stock control, setting up different staff accounts or sorting out digital receipts as mentioned above. They also offer the option to process cash payments so you can keep track of both card and cash sales. The ability to accept card payments anywhere is a massive plus. It could be useful for the self-employed who may travel. For example, a hairdresser who may travel to do home appointments, music tutors who work from home or even personal trainers offering sessions in different gyms. Just make sure you have wifi or reliable phone signal to complete payments.

You can also manage your payment terminal on a desktop or laptop by going to the provider's website. Functionality can include editing your products or viewing reports from your sales, another handy option to keep an eye on everything going on in your business.

They all vary in price depending on which model of card reader you decide to buy. It will all depend on the features you want or need. Sometimes companies offer a free card reader to get you to sign up with them, so it is worth keeping an eye out for these promotions.

How long it takes to get paid..

One of the benefits of cash payments is that you have the money straight away. With card payments, you may have to wait a few days until it reaches your bank account. In doing research, it varies from company to company. Some of them aim to have it transferred by the next business day, while some say 1-3 days. Some offer instant transfers for a fee. It is something to take on board, depending on your business needs. These transfers can be made via the app or by signing on to the web address of whichever company you use and requesting the payout there.

Companies

I hope after reading the above information that you have a bit more knowledge on what to look out for and that you’ve learnt something new. There are loads of companies out there who provide these services, but here are 3 I recommend checking out.

Sum Up:

Pros: Cheapest processing fee at 1.69%.

Square:

Pros: The Square terminal is the coolest bit of hardware. It uses a touch screen built-in and no phone or tablet is required.

iZettle:

Pros: The smartphone app is probably the best out of the three. It is clean and easily managed.

Is it time for your business to start accepting card payments? If you have any questions or want some more advice, get in touch.